Public Sector

It's our commitment to craft innovative digital solutions and empower government agencies, municipalities, and institutions to thrive in the digital age. Join us on a journey of discovery, where the synergy of AI and personalized services paves the way.

How can we foster more efficient and citizen-centric solutions? At Euvic, we comprehend the potential of technology in enhancing public services. Let's collaborate to build a brighter tomorrow for our communities.

What can we do for you?

Cutting-edge civic tech solutions

At Euvic, we're shaping the future of public services. Our proficiency in technology-driven civic innovations encompasses a wide array of solutions. We harness the power of AI-driven civic analytics, immersive virtual citizen engagement, and adaptive service delivery systems. Dive into the world of technology-enhanced public service with us.

Digital evolution

In the era of digital evolution, public institutions face new challenges and opportunities. Euvic is at the forefront of transforming traditional public services into dynamic digital experiences. Join us on the journey to create citizen-centric digital environments that empower our communities for the ever-changing landscape ahead.

Sustainable development

Sustainability is a global imperative, and we are dedicated to assisting public institutions in taking the lead. Our sustainable development solutions encompass green infrastructure planning, the integration of renewable energy, and environmental impact assessments. Partner with us to drive sustainability initiatives that benefit both your company and the planet.

What are the challenges in the public sector?

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.

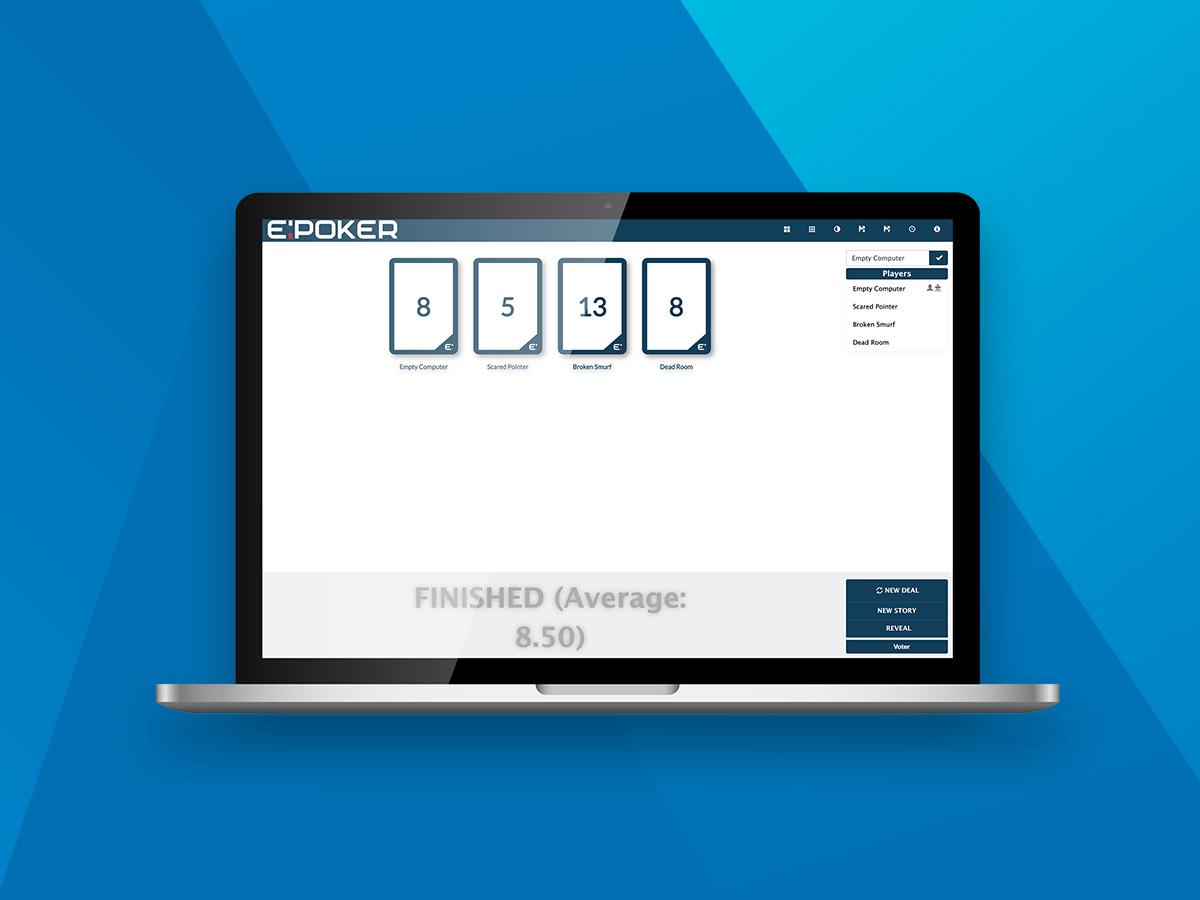

Systems integration

Modernization of IT systems

Big data

Municipal contact center

Cloud computing

IT infrastructure

All data available in one place.

Public institutions tend to use numerous IT systems, often outdated and completely unrelated. The challenge is to integrate them properly and securely while maintaining high performance.

Key benefits of IT systems integration:

- Better work organization.

- Guarantee of data security.

- Proper internal and external communication.

- Easy management of geographically dispersed official units.