Open Life

Registration and customer service system for insurance

Client:

Open Life Towarzystwo Ubezpieczeń Życie Spółka Akcyjna (Open Life Life Insurance Company)

Industry:

Insurance

Country:

Poland

Service:

Software development

Client_

Open Life Towarzystwo Ubezpieczeń Życie S.A. is a leading Polish life insurance company operating since 2011. The company specializes in life insurance, investment products, and savings solutions, targeting both individual clients and business partners – banks, financial institutions, and insurance intermediaries. Open Life holds a prominent position in the Polish life insurance market, offering innovative financial solutions tailored to client needs.

Challenge_

Open Life was looking for a solution to handle sales and management of insurance policies for both individual clients and insurance partners. One of the basic requirements was the ability to design and register new insurance products and modify existing ones without the need to involve the IT service provider. The solution also required integration with many of the Company’s internal systems.

Project scope_

- Analysis

- Product development

- Web development

- Systems integration

- Oracle BI Publisher integration

- MojeID integration

- API provisioning

- Development and maintenance

Solution_

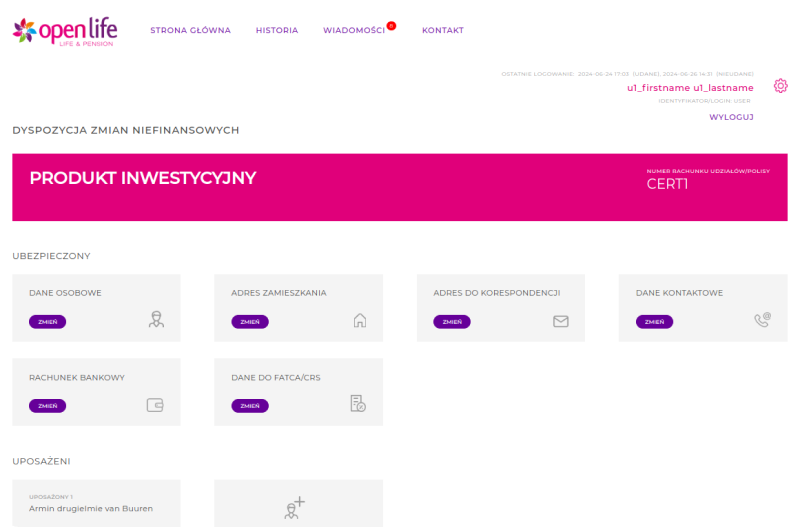

In response to Open Life’s needs, we created a comprehensive, two-part IT system consisting of a Registrar (backend) and a Client Portal (frontend). An InOut module was also implemented, enabling data synchronization between Open Life systems.

Our solution enables online insurance sales and management, covering life, property, and investment policies. The system also enables product sales and registration by Open Life partners, such as financial intermediaries and banks.

The portal was integrated with Oracle BI Publisher printing system, MojeID, and Open Life product systems. According to client requirements, the portals support responsive web design (RWD).

The following modules were created as part of our solution:

1: Post-sales module

A module available to both individual clients and intermediaries cooperating with Open Life. It allows clients to view their policies, check funds, register and view disposition history. Intermediaries can search for their clients and manage policies on their behalf.

2: Product management and application handling process module

The module enables intuitive product definition, including specification of application form and printout, as well as parameters such as sales date or documents related to the product. It also provides the ability to assign a product to a specific intermediary, define application statuses, and perform status transition operations.

3: Sales structure management module

The module allows adding intermediaries and their branches. It enables intermediary administrators to manage their own organizational structure, create branches and employees, and grant them appropriate permissions. The system also provides generation of periodic reports, such as sales statistics.

Result_

Since implementation in 2012, we have provided continuous maintenance and further development of the created portal. As part of maintenance services, we guarantee automatic vulnerability detection and library update mechanisms, ensuring system security and stability.

The system we created for Open Life not only streamlined the process of selling and managing insurance, but also integrated various systems and modules into one coherent platform. Thanks to this, Open Life was able to increase operational efficiency and improve the quality of service to its clients and partners.

Technologies_

- Java / Spring / SpringBoot

- Hibernate / JPA

- Freemarker

- Maven

- GIT

- PostgreSQL

- Multi-channel Insurance Sales

- Tomcat

Testimonials_

“The Euvic Group team has been Open Life’s technology partner for many years. They are responsible for the development and maintenance of one of our main systems. They have never let us down. We could always count on partner-like and effective cooperation”.